This project truly shows the impact of empathetic design thinking while working within the constraints of the highly regulated collections space.

Initially, I was brought on this project to help conduct user research and explore design variations. When the lead designer left the company, I took over as lead and quickly pivoted due to feedback from legal and additional requirements. I created the go-to market MVP solution for the U.S. and worked closely with product, legal/compliance, content, and engineering to bring this experience to fruition.

My role: Lead designer

Platforms: Responsive web

Disciplines: UX/UI, Prototyping, User Research/Testing

Tools: Sketch, InvisionApp

Launch: October 2017

Some PayPal Credit users fall behind in payments due to unforeseen circumstances. Payment plans are available, but they are only offered through speaking with a customer service agent/rep.

- Stay true to the PayPal brand attribute of “on your side” by being as transparent as possible

- Make it simple and easy for a customer to self-enroll in a payment plan, make payments online, and track payment plan progress

- Reduce calls to customer service related to collections

- Mitigate loss and reduce net credit losses (NCL) by millions annually

Recommend a plan

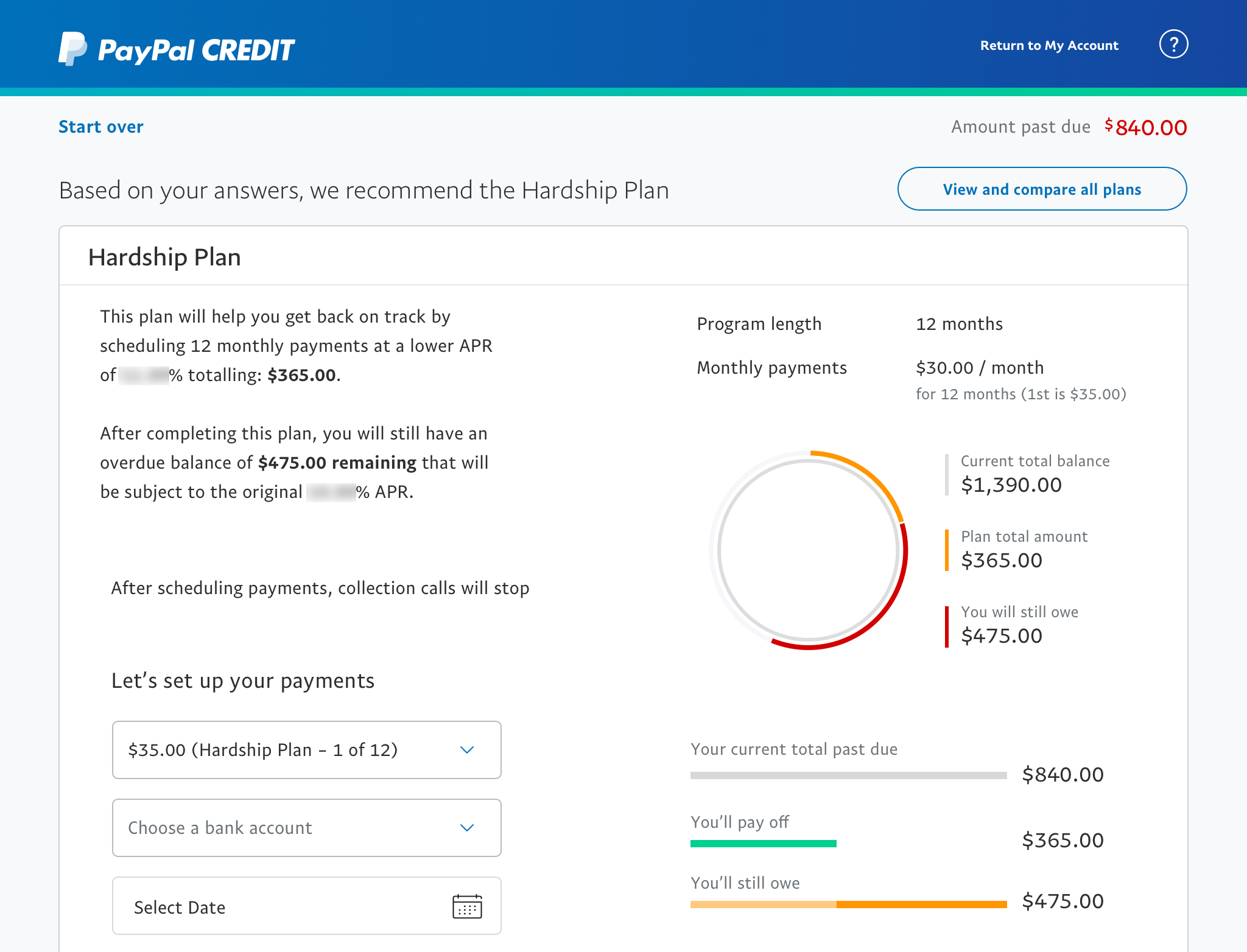

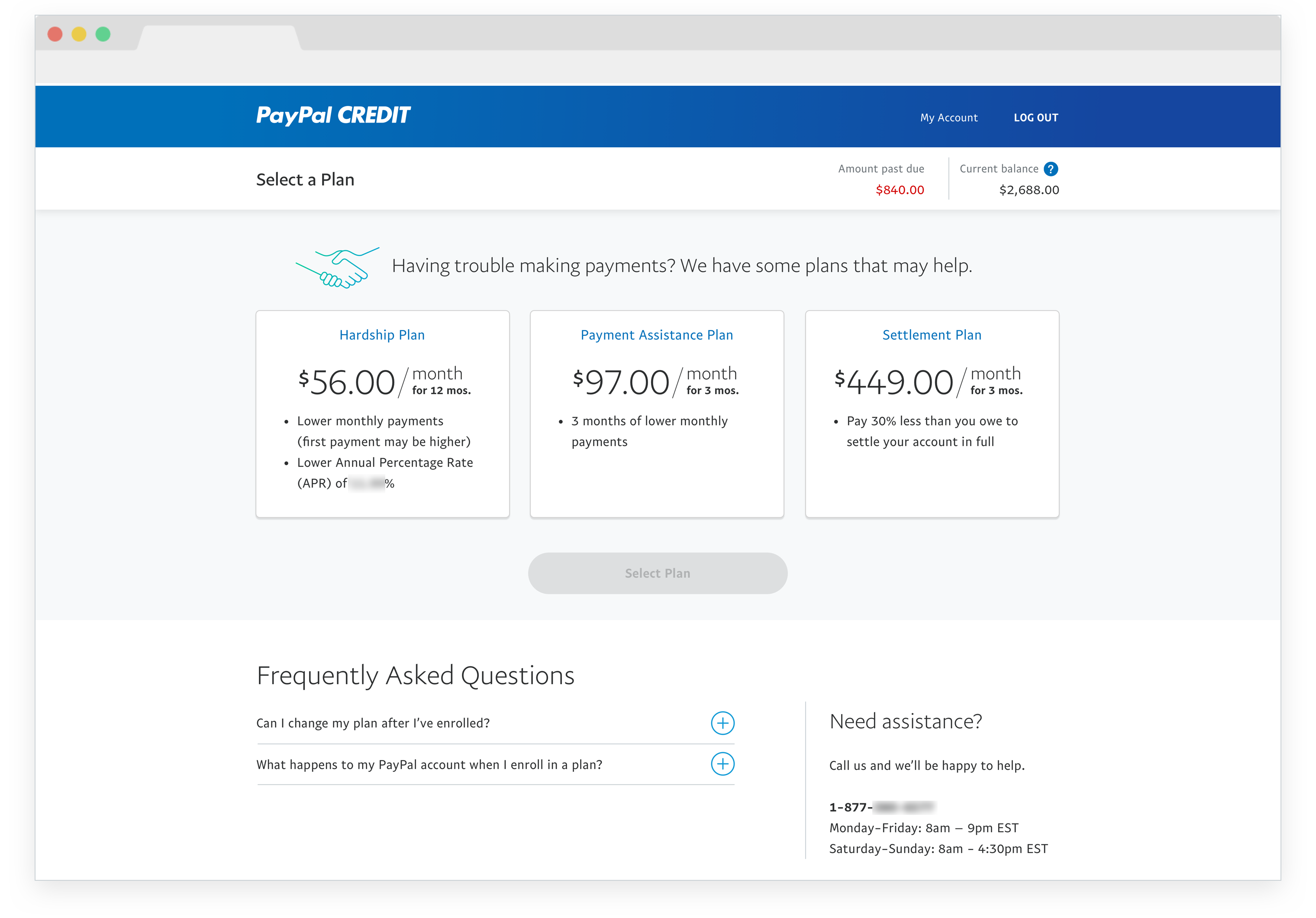

The first idea I tried was to create a flowchart of questions where depending on the answers, the user would get recommended the right plan for them. My rationale is the user is already stressed, so I wanted to guide them through and sprinkle as much encouragement throughout the experience.

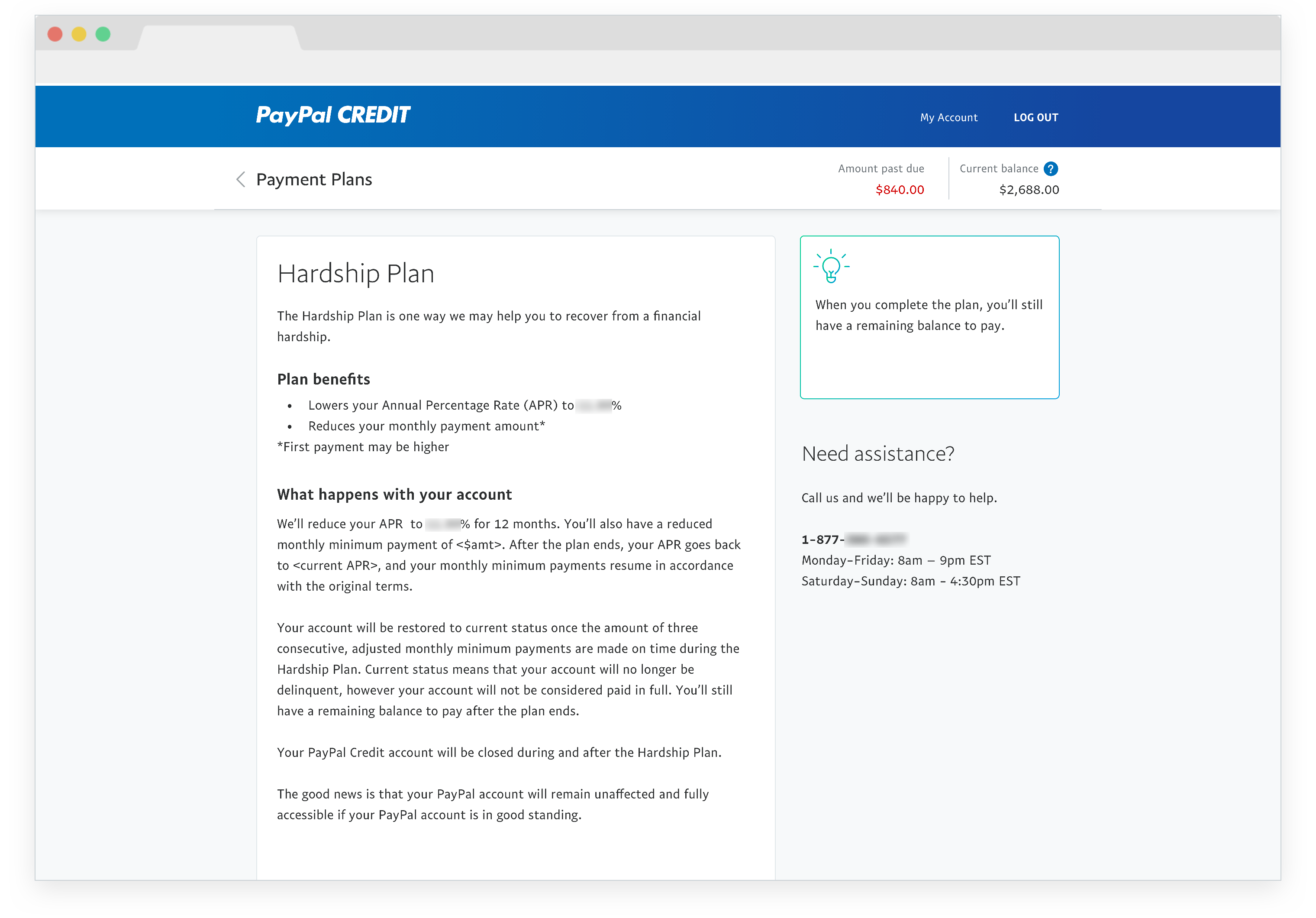

Visualize plan details

I explored many ways to explain how the plan works, from different layouts to visual graphs. I wanted to over explain as much as possible so that the user knows exactly what this plan means to them.

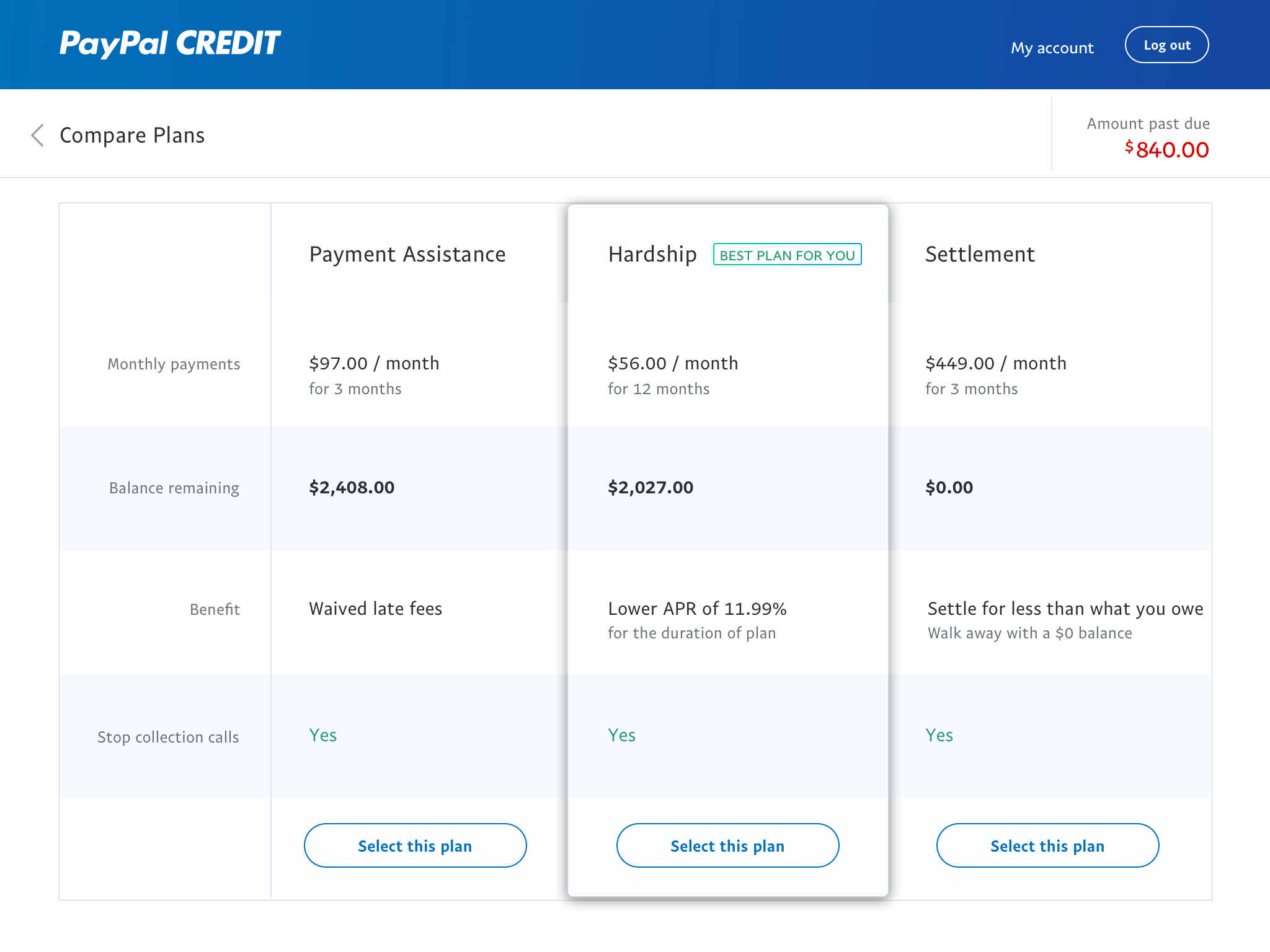

Comparison table

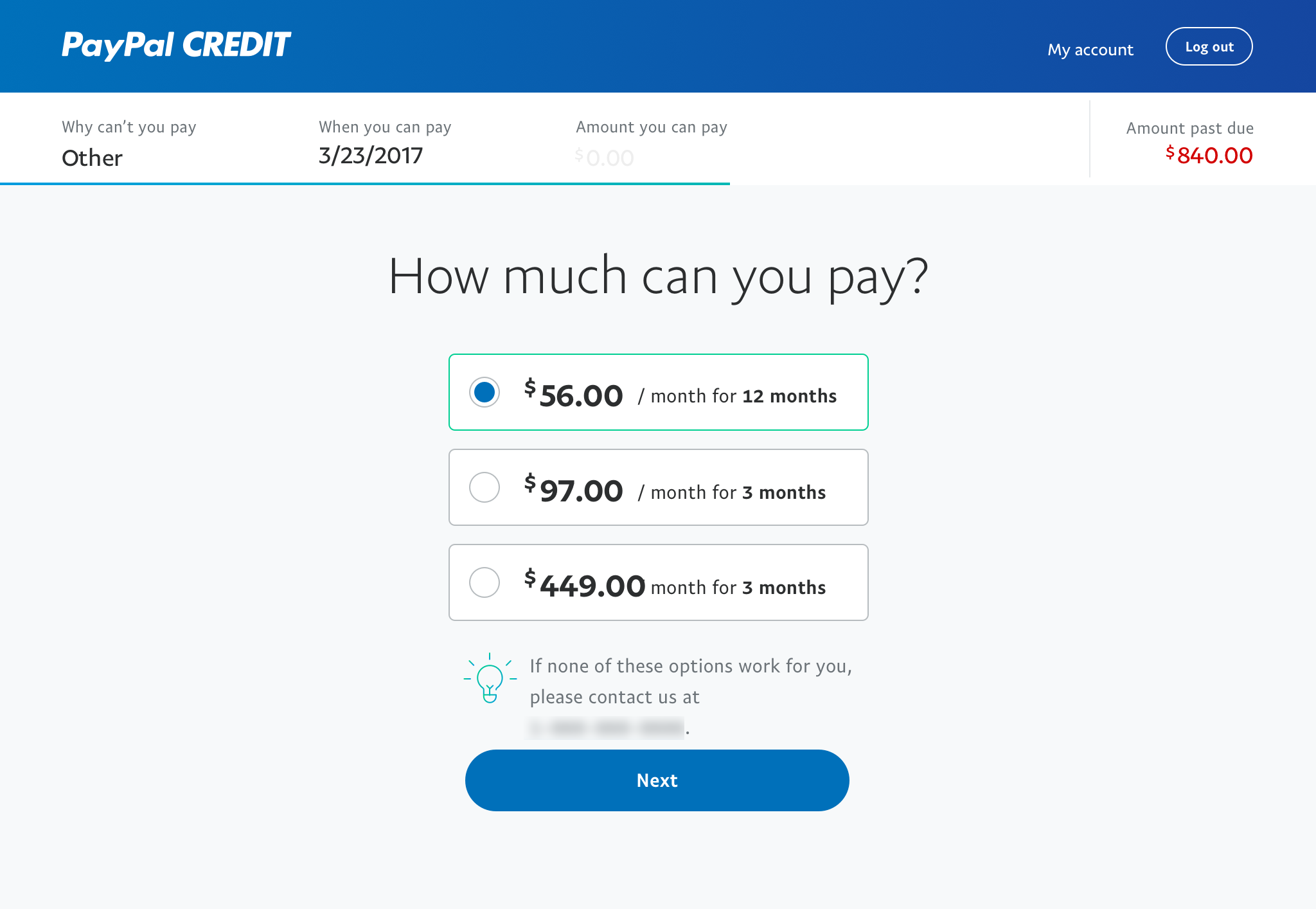

This idea is to pull out the key similarities and differences between each plan and display them in a scannable way. However, the plans are a bit like comparing apples and oranges.

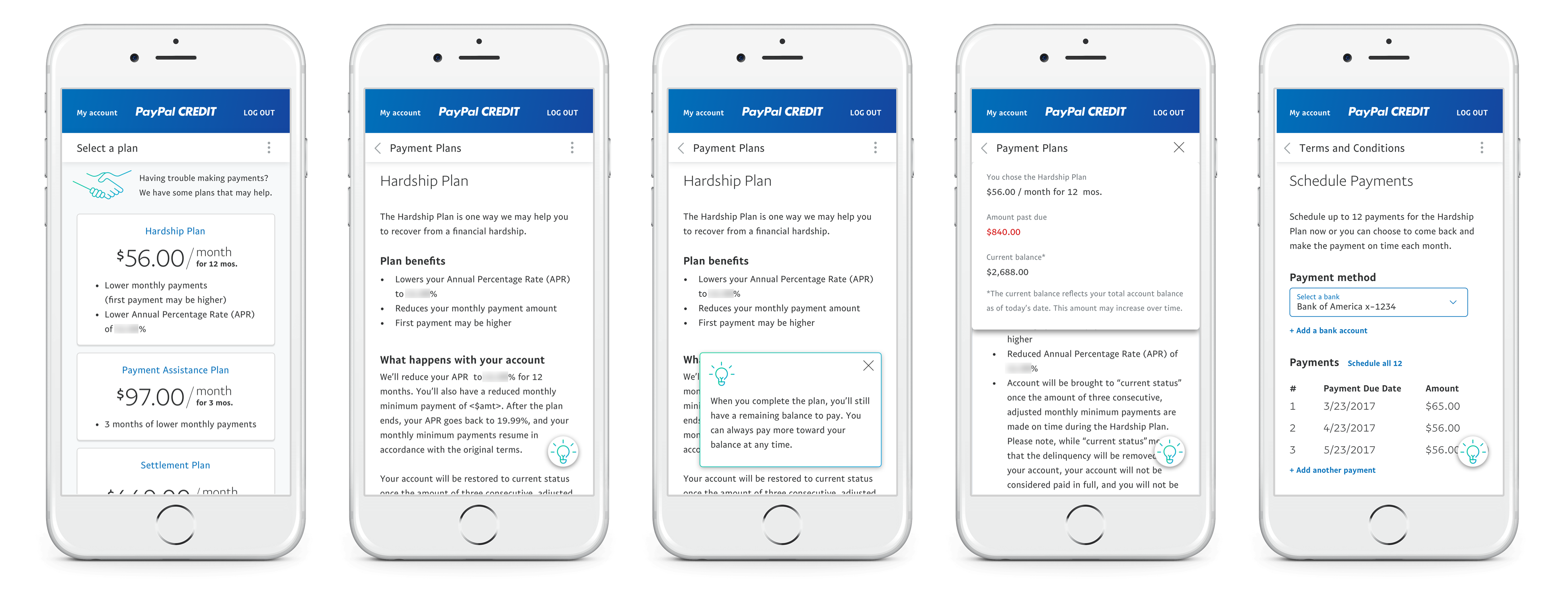

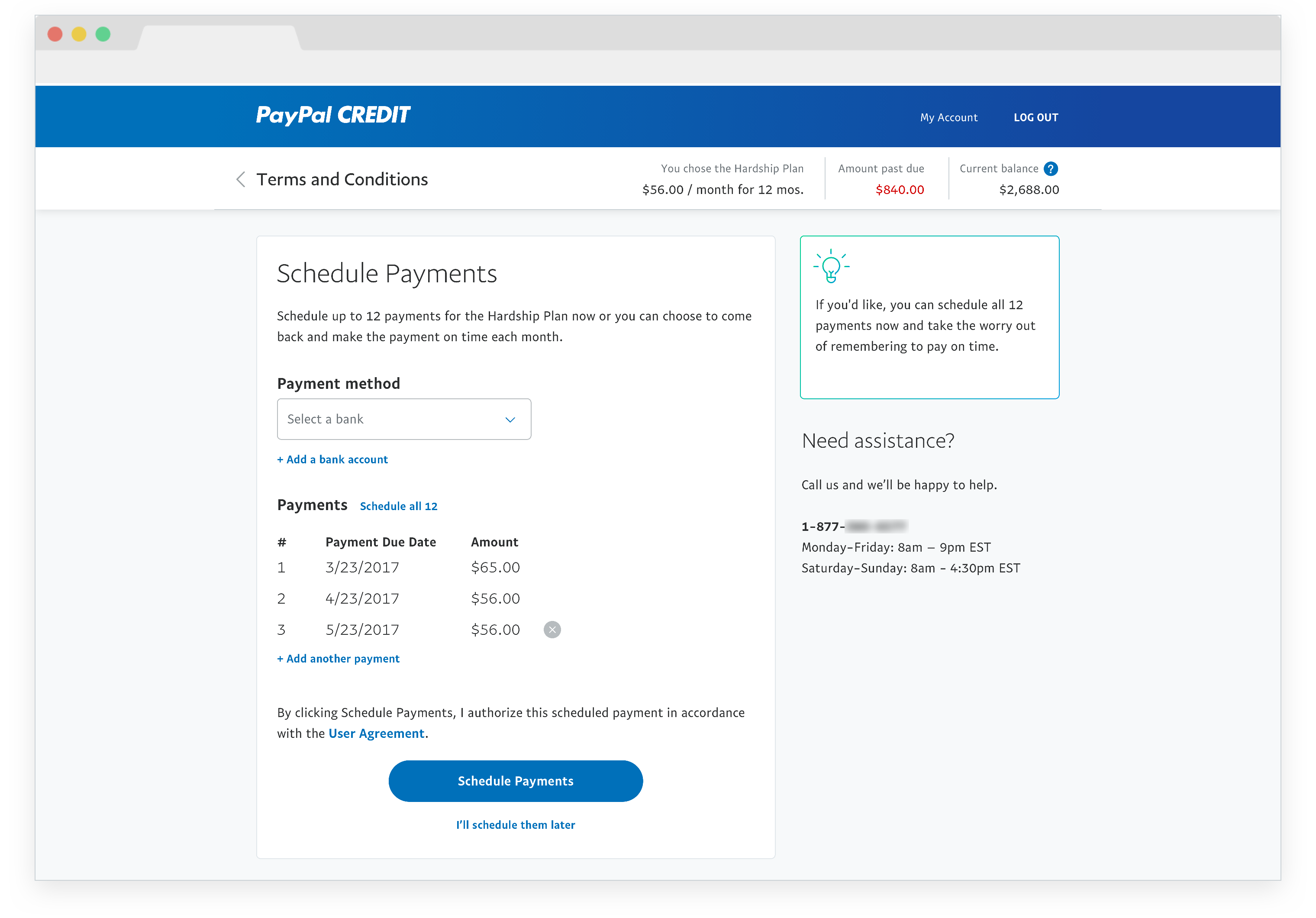

Mobile web screens showing how the persistent top bar and tips box collapse and expand

Success was measured by the amount of users who successfully enrolled in a plan, and even more so on the amount of users who schedule a payment. This is because someone could enroll but never make any payments, so they wouldn’t be moving the needle on getting back to good status.

I’m really proud of this project because of the legal challenges I transformed into friendly UX. Even though my initial idea wasn’t built, I was able to bring a lot of my original features/elements such as encouraging tips to the final design.